An IRS Scammer tries to strike!

Well folks, it looks like I’m due for a tax refund! I received an official email from the IRS saying that they owe me over $500! All I have to do is click the claim form button in the email and it will take me to their official website where I just fill out the form that they need and I’ll be able to get a refund! I mean, there’s no ways this could be from an IRS scammer!

This is definitely legitimate right? I mean it’s not every day that I get an email from the IRS saying that they owe me money. In fact, I can’t think if any other time I’ve ever gotten an email from the IRS so it definitely must be from them. Even the email address looks like it’s legitimate as it says irs.gov.

What are the chances that this email is really a scam? Well, I’m going to go over that as well as red flags to look out for that will show this email is from a scammer. It’ll be very similar to my last one that had to do with Amazon and you can read about that by clicking here.

Am I really going to get money from the IRS?

First off, I will say that there are people getting paid from the IRS as I speak and generally has to do with the pandemic and what the Federal Government has passed. Also, we can’t forget about some of the past stimulus checks that have gone out to a lot of US residents.

It’s understandable to want to see if you’re truly going to be getting more money from the IRS as I certainly would love to at the moment as well, however, you have to meet certain credentials in order to receive money from the IRS and unfortunately for me, I don’t meet those credentials which would be required for the child tax credit. I don’t have any children or dependants so I don’t get anything.

Also, in most cases you won’t have to fill out a form in order to be qualified to receive the child tax credit. If you filed 2019 and 2020 taxes, the IRS will be able to look at that to see whether you have children or not and will automatically send out payments either in the form of direct deposit or a physical check if they deem that you qualify for it.

Will you have to fill out any kind of form in order to receive some kind of stimulus or tax credit? Well, there are forms you can fill out at the IRS’ official website, but they won’t send you an email asking you to click a link inside of it in order to fill out a form. All the forms for anything regarding taxes and credits will be at their website. Now lets take a closer look and see what makes this particular email a scam.

The Body of the Email

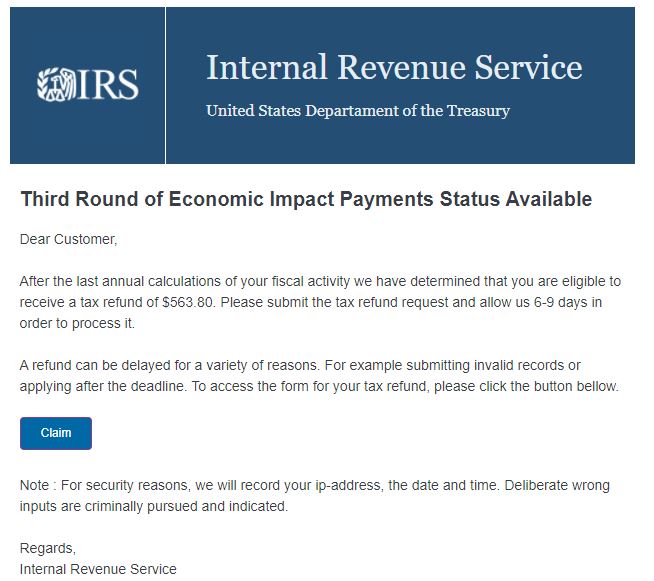

I’ve said this in my previous article and on others regarding phishing emails, but I’ll say it again. A lot of times scammers will have spelling and grammar errors in their emails and it does make it a lot easier to tell that it is a scam. Unfortunately, they’ve been getting a lot better at making those kinds errors non existent in some of their emails and in the case of this one, they are a little trickier to spot. Don’t worry though, there are other ways to see if an email is a scam. Here is what the body of the email says:

“Dear Customer,

After the last annual calculations of your fiscal activity we have determined that you are eligible to receive a tax refund of $563.80. Please submit the tax refund request and allow us 6-9 days in order to process it.

A refund can be delayed for a variety of reasons. For example submitting invalid records or applying after the deadline. To access the form for your tax refund, please click the button bellow.

Note : For security reasons, we will record your ip-address, the date and time. Deliberate wrong inputs are criminally pursued and indicated.

Regards,

Internal Revenue Service“

There are just a few grammar and spelling errors in this message, but they are little hard to spot, especially the lone spelling error that I see. There are a few places in the body of that email where commas could go and also the word that is misspelled is below as they have it spelled as bellow.

Now let’s take a closer look at the top of the message. Notice how it says “Dear Customer”. In my last article about an Amazon email phishing scam, It started off the same way as this. If you have an account with a company or have done your taxes and sent them to the IRS, they will have your name on file and should use your first name to address you, not as dear customer.

It should be addressed to you instead of any random person being addressed as dear customer. That’s a huge red flag that this is a scam since they fail to address you by name. Are there any other ways to see that this email is from a scammer? The answer is yes and I’ll go over that next as this is the biggest red flag of them all.

The Email Address

You should always check the email address that an email came from as this will always be your biggest red flag that an email is a phishing attempt. Now when you first see the email in your inbox, it might look like it legitimately came from an email address of the company or organization. In this case, it’s supposed to come from the IRS.

At first glance it does look like it came from them as it says IRS.gov which would be something a government organization would use, which is .gov. The scammers are actually trying to disguise the actual email address that this particular email came from. The good news is they can’t keep it fully hidden.

If you open up the email and look up towards the top, you’ll see IRS.gov, but immediately next to it, you’ll see the actual email address and it resembles nothing like an actual IRS email address. It just seems like a long series of random numbers and letters and then it ends with att-mail.com.

This will always be your biggest red flag because the scammers cannot fully hide the email address it came from even though it’ll initially look like they did. If you’re ever in doubt about the legitimacy of an email, always check the email address it was sent from.

What happens if you click the link inside?

Let’s say you believed the email was truly legitimate and you clicked the link inside the email. What would happen then? Well, this is where things can get really bad which is why I urge you never to click a link inside an email, especially one your not sure of where it actually came from.

This specific email that claims it’s from the IRS, really concerns me because they supposedly want you to fill out a form after you click the link. The reason I’m very concerned is that the link will likely take you to a website that’s designed to look like the IRS’ website, but really isn’t and if there truly is a form that is on that particular site, it may ask you to put in sensitive information such as your social security number, driver’s license number, and address.

Folks, if you put that kind of information in, you’re going to open yourself up to extreme fraud and possibly identity theft. While that website may look like the official one, if you look at the top of the page where the url is, you’ll quickly see that it is not the IRS’ url to its website. It’ll likely be something else that just seems random.

You never want to click the link inside this type of email because not only will it take you to a fraudulent site, the site itself could be full of malware and viruses that could damage your computer or even record whatever you type, no matter what site you’re at. It saddens me that there are people who unfortunately become victims of these type of scams and who could end up losing money, having their credit damaged, identity stolen, and much more all because they clicked the link and ended up giving away sensitive information.

Don’t let your emotions cause you to be a victim

These type of email scams are designed to fill you with strong emotions so that you won’t be thinking logically and will fall for them. In the case of the previous email scam I went over, which claimed to be from Amazon, the emotion the scammer or scammers was trying to make you feel was panic and worry. They wanted you to believe that something was truly wrong with your Amazon account and that it needed to be fixed immediately and so their hope was that you’d click the link inside the email and type in your actual Amazon log in credentials.

Now with the email here, the scammers are trying to do the opposite. They want you to be overcome with joy and excitement at the idea that you’re going to be getting a sizable refund from the IRS. You’re supposed to be getting some money and so they are hoping that in the joy and excitement that you feel, you’ll gladly click their link and fill out a bogus form that will ask you for personal information and then they’ll be able to use all of that against you.

Do not let yourself be overcome with emotion in any of these situations and think logically here. You now know what to look for that will show the email is a scam. Don’t become a victim of this IRS scammer and always remember to look at the email address that the email came from and see how the email is addressed such as “Dear Customer”.

If you always remember to pay attention to those type of red flags, you’ll be able to prevent yourself from falling for these awful scams. You can report these scams to the IRS or other government agencies so they can look further into them and get them shut down so that no one else can become a victim. Stay vigilant folks!